Bitcoin prospects bend was in backwardation for the vast majority of 2018, a year when BTC lost 74% of its worth, JPMorgan noted.

JPMorgan’s cryptographic money market experts have highlighted the distinction between Bitcoin’s (BTC) spot costs and BTC prospects costs as a possible bearish sign for the market.

In a Thursday note to customers, JPMorgan examiners drove by worldwide market tactician Nikolaos Panigirtzoglou composed that the Bitcoin market has gotten back to backwardation — a circumstance when the spot cost is above prospects costs. The investigators said that the previous month’s revision in crypto markets saw Bitcoin fates switching into backwardation interestingly since 2018.

As per the tacticians, Bitcoin prospects backwardation ought to be seen as a negative sign for BTC cost notwithstanding a significant bounce back available in the course of recent days, with Bitcoin hitting $37,500 on Thursday. The examiners focused on that the Bitcoin prospects bend was in backwardation for the vast majority of 2018, a year when Bitcoin dropped 74% subsequent to hitting its then-memorable high of $20,000 in late 2017: “We believe that the return to backwardation in recent weeks has been a negative signal pointing to a bear market. […] In our opinion the shift in Bitcoin futures into backwardation is a bearish signal echoing 2018.”

In the most recent examination, JPMorgan explicitly took a gander at a 21-day moving normal of the second Bitcoin fates spread over spot costs. The investigators noticed an “unusual development and a reflection of how weak Bitcoin demand is at the moment from institutional investors” who exchange fates contracts on the Chicago Mercantile Exchange.

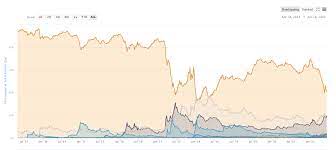

The examiners additionally noticed that Bitcoin’s debilitated offer in the complete crypto market esteem is another unsettling pattern. As recently revealed by Cointelegraph, Bitcoin predominance on crypto markets failed to 40% in late May, denoting the most reduced offer in the course of recent years subsequent to flooding above 70% this January.

At the hour of composing, Bitcoin’s offer in the complete crypto market capitalization is 43%, representing $682 billion out of the absolute crypto market worth of $1.6 trillion, as per information from CoinMarketCap. A few experts like crypto file supplier Stack Funds accept that BTC strength could retest its past highs for the time being.

Disclaimer: The views, suggestions, and opinions expressed here are the sole responsibility of the experts. No Blockchain News Site journalist was involved in the writing and production of this article.